Our Financial Advisors in Santa Clarita provide Wealth Management and Financial Planning services to select families, business owners and professional entertainers and athletes. Our Financial Advisors in Southern California are experts in helping individuals and businesses with financial planning and investment advice. Clients benefit from our financial advice in not only protecting their financial assets but growing them over time with our unique Advance and Protect Financial Strategies.

Our Private Wealth Management services for high net worth individuals encompassing financial planning, estate planning and tax strategies.

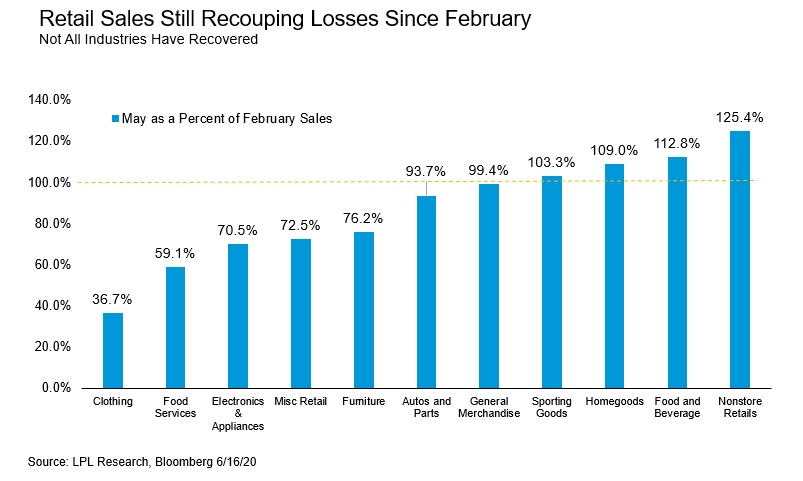

Retail Sales Beat Shows Consumers Coming Back Strong

admin2020-06-18T07:44:46-07:00COVID-19 has decimated global demand as lockdowns materially re-shaped consumer and business behavior. Even as states have begun to re-open, significant questions remain about how demand could recover. The May retail sales print provided one of the first glimpses of that answer, rising 17.7% month over month and marking the largest monthly gain since data [...]