Our Financial Advisors in Santa Clarita provide Wealth Management and Financial Planning services to select families, business owners and professional entertainers and athletes. Our Financial Advisors in Southern California are experts in helping individuals and businesses with financial planning and investment advice. Clients benefit from our financial advice in not only protecting their financial assets but growing them over time with our unique Advance and Protect Financial Strategies.

Our Private Wealth Management services for high net worth individuals encompassing financial planning, estate planning and tax strategies.

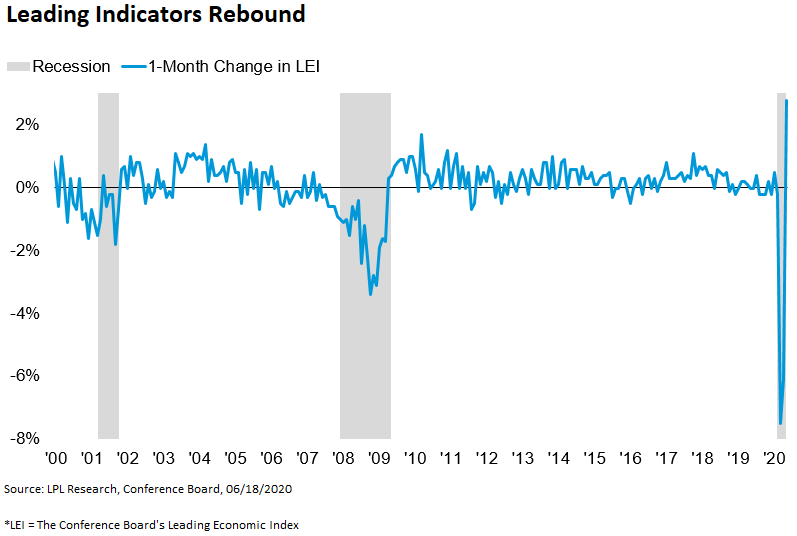

When Do Rates Start Rising After a Recession?

admin2020-09-02T11:51:11-07:00As the economy begins to recover, with the early stage more robust than expected, we increasingly get asked when interest rates will move meaningfully higher. As shown in the LPL Chart of the Day, historically rates don’t start to move higher until a median of about two years after a recession starts, and five [...]