Our Financial Advisors in Santa Clarita provide Wealth Management and Financial Planning services to select families, business owners and professional entertainers and athletes. Our Financial Advisors in Southern California are experts in helping individuals and businesses with financial planning and investment advice. Clients benefit from our financial advice in not only protecting their financial assets but growing them over time with our unique Advance and Protect Financial Strategies.

Our Private Wealth Management services for high net worth individuals encompassing financial planning, estate planning and tax strategies.

Erick, I’m nervous! What do I do now? 3 Questions I Am Being Asked Lately

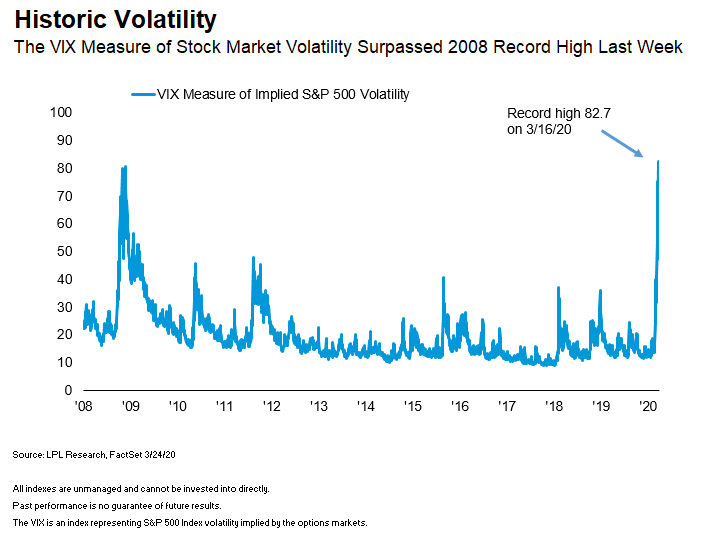

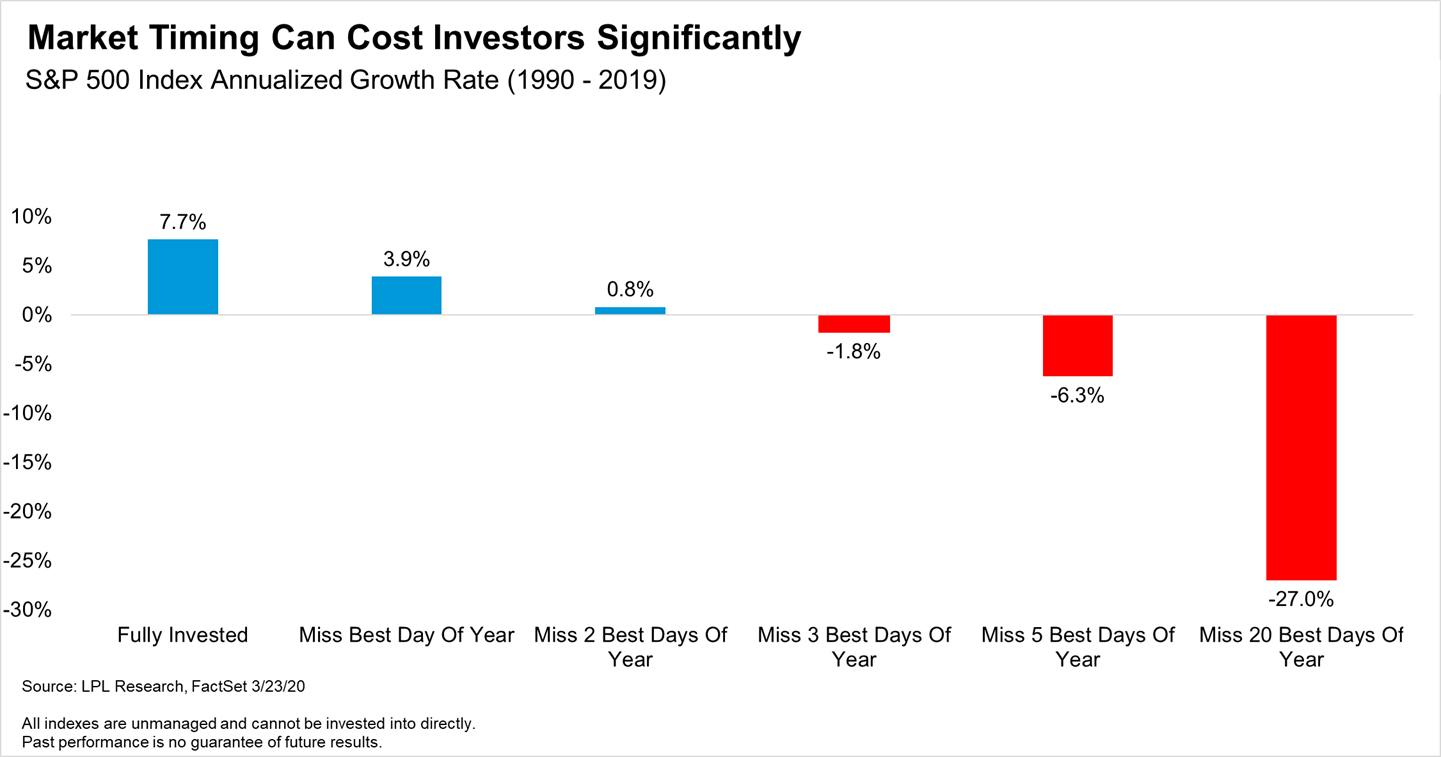

admin2020-03-27T07:19:34-07:00Another wild week. The emotions are running high and that might cause you to make bad decisions about your money and your 401(k). In the last few days I've gotten calls asking: "What do I do now?" - Some clients want to cash out or move to a money market. If you do, when the [...]