Our Financial Advisors in Santa Clarita provide Wealth Management and Financial Planning services to select families, business owners and professional entertainers and athletes. Our Financial Advisors in Southern California are experts in helping individuals and businesses with financial planning and investment advice. Clients benefit from our financial advice in not only protecting their financial assets but growing them over time with our unique Advance and Protect Financial Strategies.

Our Private Wealth Management services for high net worth individuals encompassing financial planning, estate planning and tax strategies.

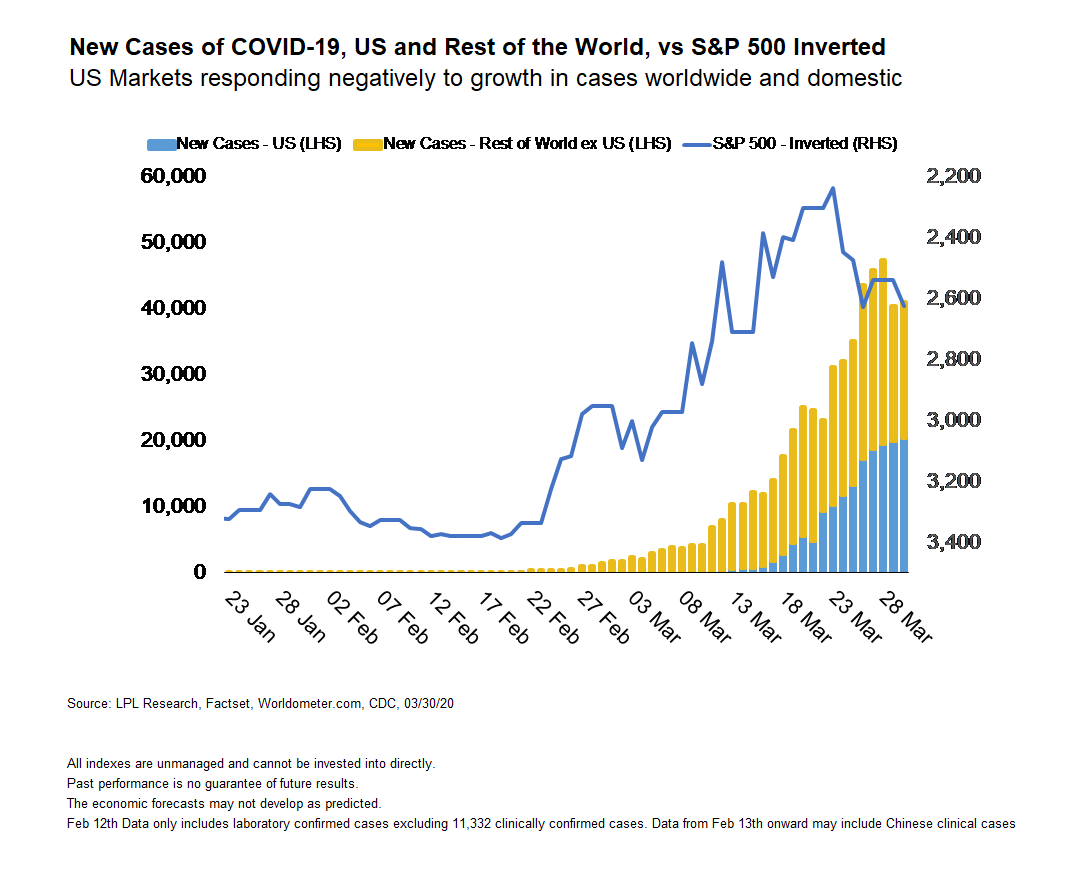

Peak COVID-19 Cases

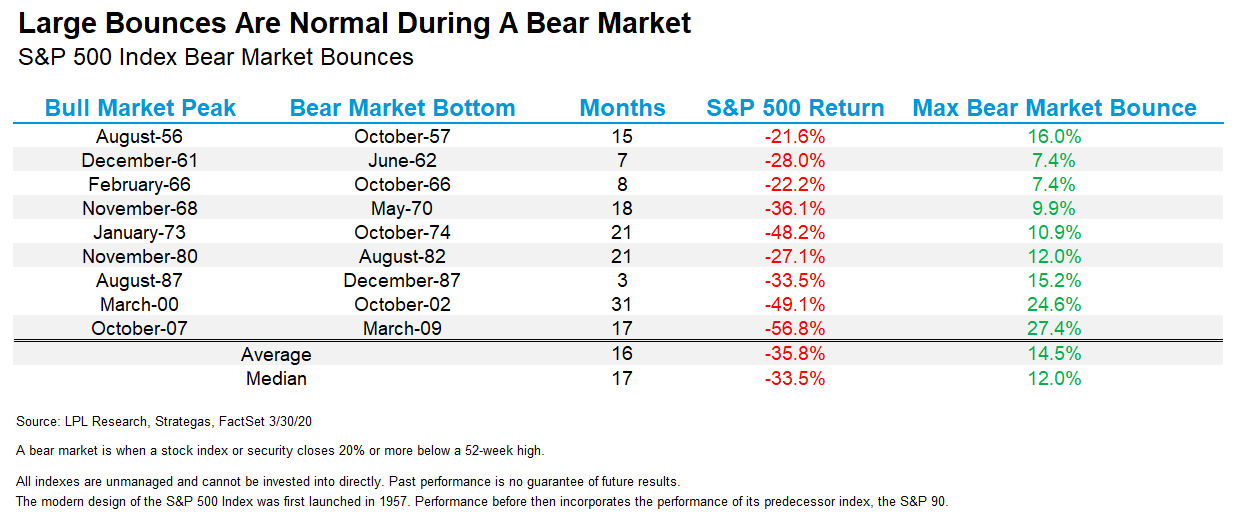

admin2020-04-29T13:40:14-07:00We continue to follow our Road to Recovery Playbook for help determining where the market is in its bottoming process and yesterday we upgraded Signal #1, confidence in timing of a peak in new COVID-19 cases, to “Already there.” “Three of the five signals from our Road to Recovery Playbook are now in place,” said LPL Financial Equity Strategist [...]