Trusts – Myths and Misconceptions about Estate Planning

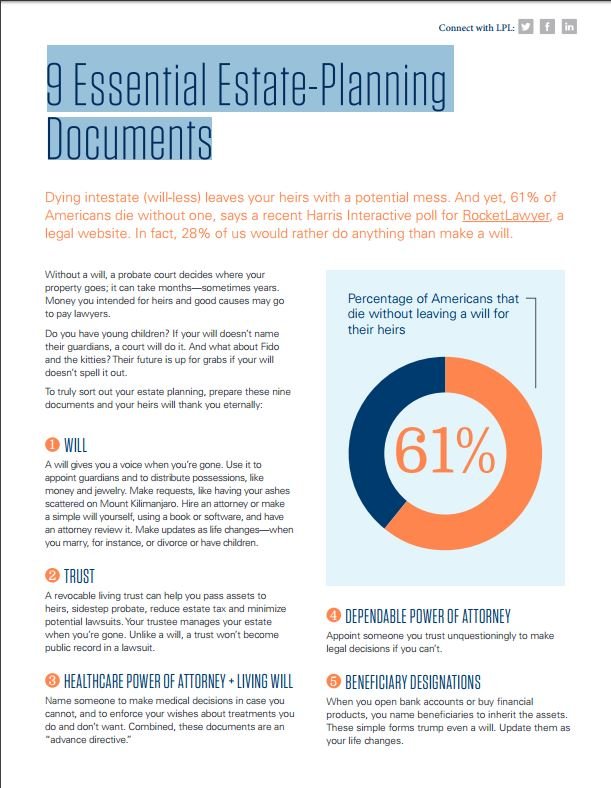

Erick Arndt2024-04-12T16:07:43-07:00Trusts are an important part of an overall estate plan, and should not be overlooked For the average investor, setting up a trust with your estate attorney as part of estate planning can make a lot of sense. For wealthy investors, it can be nearly essential. So why then do only 33% of Americans [...]