Earnings Estimates Impressively Rose. Recession likely?

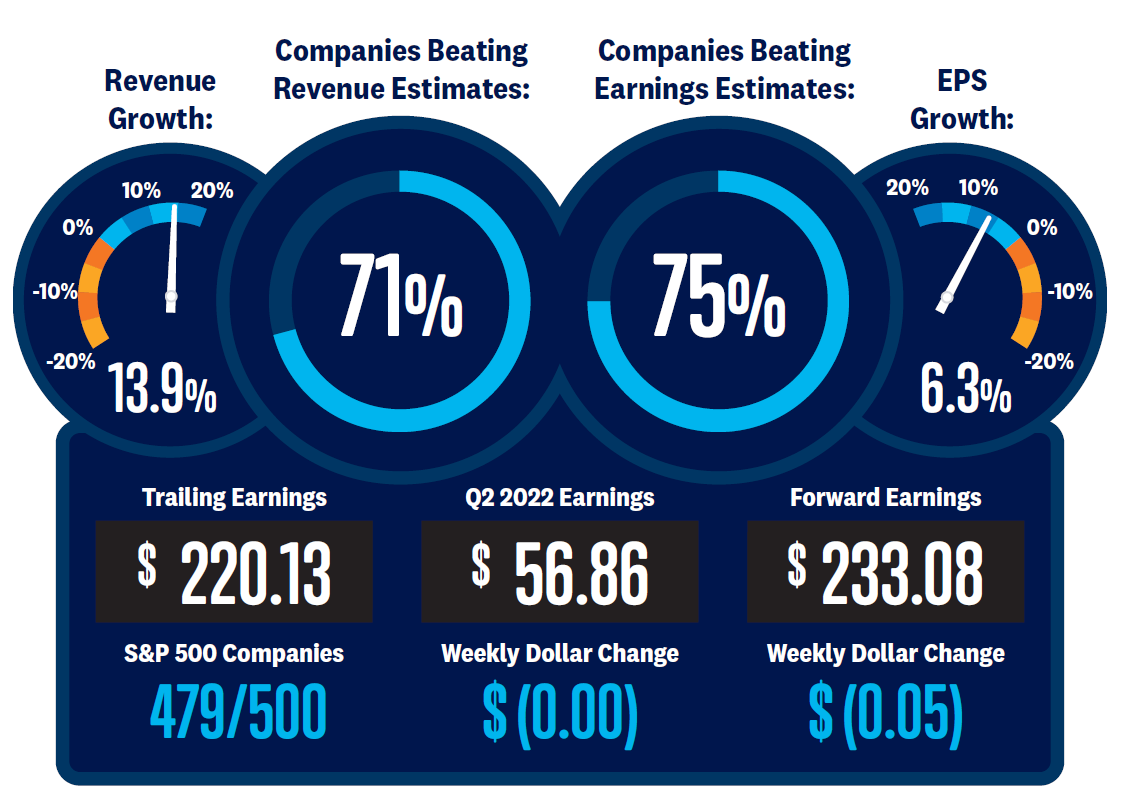

Erick Arndt2023-05-01T10:18:36-07:00Earnings Estimates for 2023 Impressively Rose Last Week With just over half of S&P 500 companies having reported results, the consensus estimate for S&P 500 year-over-year earnings growth in the first quarter is -3.7%, up more than 2 percentage points from the prior week. While an earnings recession is likely, with a second straight [...]