Earnings Season Ends With a Whimper – Where will stock market go from here?

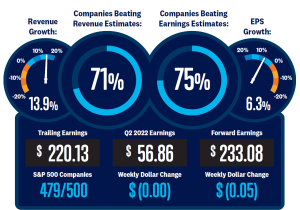

- Mixed results from mostly retailers, pushed S&P 500 earnings growth down from 6.4% to 6.3% last week, though that growth rate is still 2.2 percentage points above the June 30 estimate.

- Energy, healthcare, and utilities have produced the biggest upside earnings surprises, though energy remains by far the biggest earnings growth driver.

- This pace of earnings growth is solid given the challenges, though S&P 500 earnings would be down year over year, excluding energy.

- The consensus for the next 12 month S&P 500 earnings per share (EPS) estimate has been reduced by 3.1 percentage points since June 30, slightly more than the long-term average but not unexpected amid cost pressures, slow growth, and a strong dollar.

- LPL Research S&P 500 EPS forecasts remain below consensus for 2022 ($225 vs. $226.55) and 2023 ($235 vs. $244.04). The consensus 2023 estimate likely has to come down a fair amount.

With just a couple dozen S&P 500 companies left to report, these numbers are largely locked in and earnings are unlikely to move the market until focus turns to third quarter results.

Many people spend 10, 20, and 30 years working and end up with very little savings. Don't be one of them! Avoid these 12 financial mistakes so you can build wealth over your lifetime. Share them with friends, share them with family.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact

MRR approval: 05196504

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal.

This material was prepared by LPL Financial, LLC.