9 Essential Estate-Planning Documents

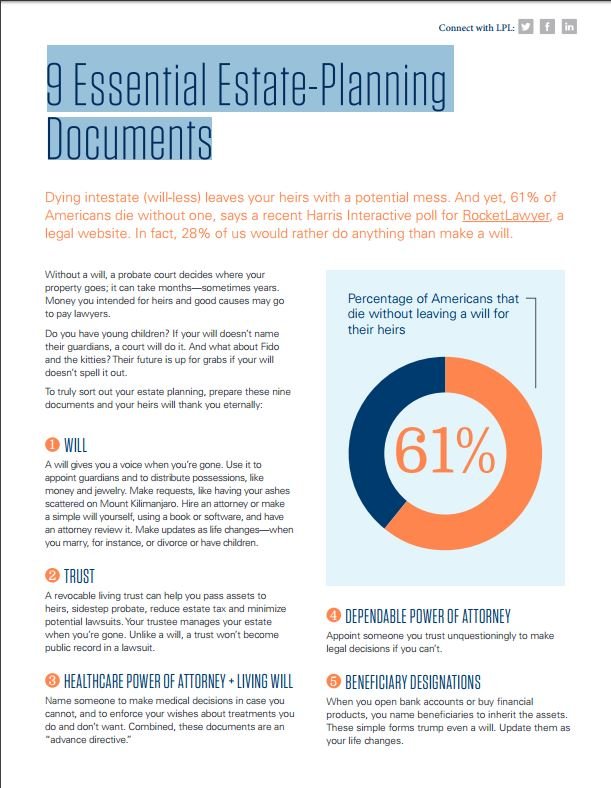

admin2016-12-14T17:05:00-08:00Estate-planning can be confusing...and boring. Yet, it is a critical part of your financial plan. This article is from Nerd Wallet. Dying intestate (will-less) leaves your heirs with a potential mess. And yet, 61% of Americans die without one, says a recent Harris Interactive poll for RocketLawyer, a legal website. In fact, 28% of us would rather do anything than [...]