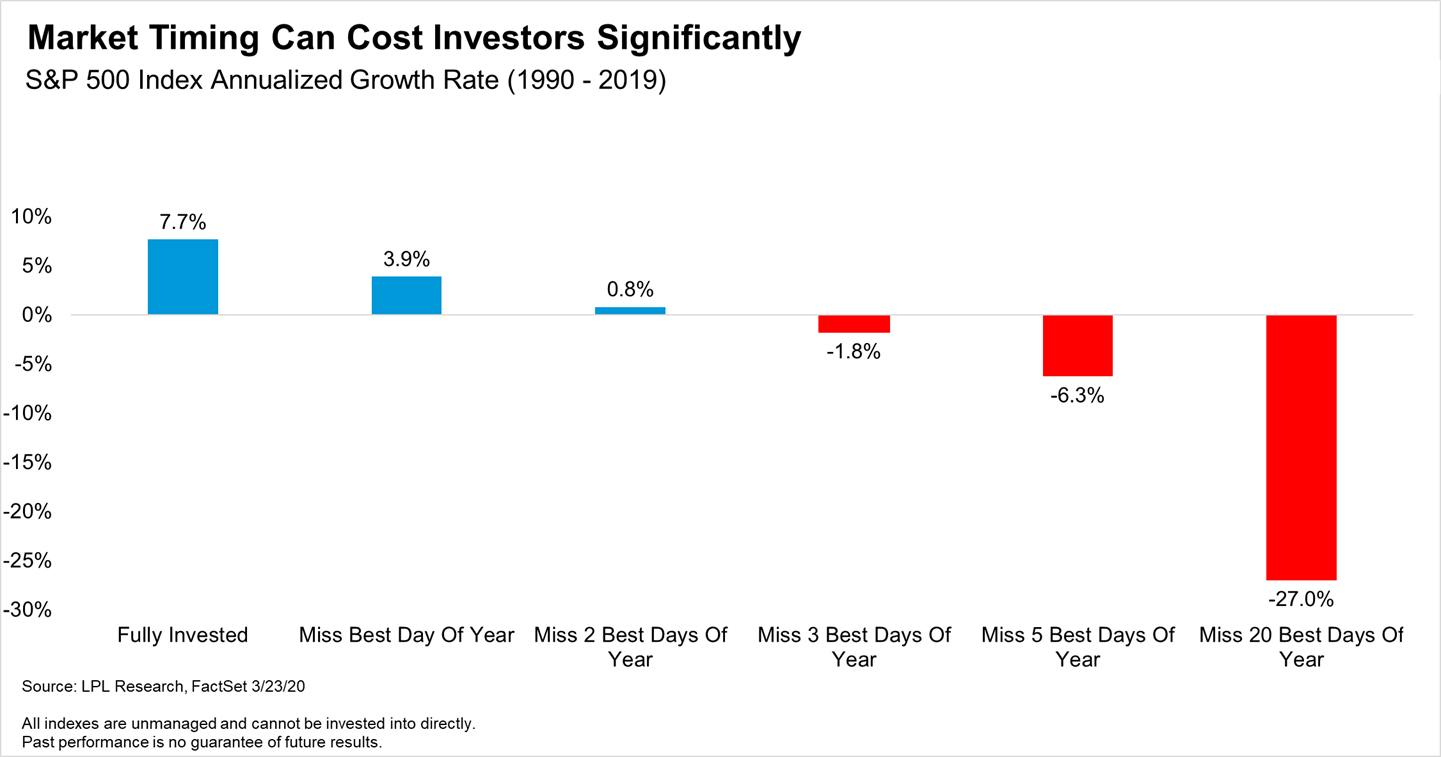

Time In The Market Versus Timing The Market

admin2020-03-24T14:12:21-07:00The incredible volatility continues, with the S&P 500 Index now in one of its worst bear markets ever, along the way making the quickest move from an all-time high to down 30% at only 22 days. What is a long-term investor to do? “Although market timing is very alluring to investors, especially after the past [...]