Supporting actors can help prepare you for your retirement close-up

It’s no coincidence that the best film award of the year is announced at the very end of the annual Academy Awards® in Los Angeles.1 While it is entertaining to watch stars pose on the red carpet, laugh at Billy Crystal dancing across the stage, and tear up at emotional acceptance speeches, we all stay up late in anticipation of the big reveal, the ultimate payoff—for many, a moment just as dramatic as proudly accepting an award in front of a celebrity audience.

How you invest for retirement is like a producer preparing an Oscar®-worthy film—combining top writers, directors, lead and supporting actors, composers and editors. The same idea applies to your retirement—you need support from your employer, pretax paycheck contributions, asset allocation decisions and ongoing monitoring in order to make your “winning picture” in retirement. Here are four ways to walk away with the Oscar.

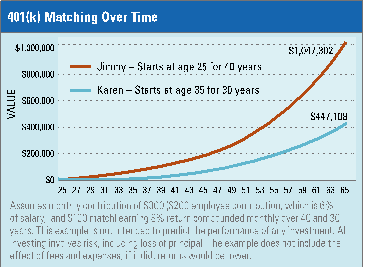

1- Play a role matched to your strengths. If you participate in your company 401(k) plan, your employer may make matching contributions if you are saving enough to qualify for the maximum match. Taking advantage of the match can make a big difference in your savings, as the following chart shows.

Let’s pretend Jimmy and Karen start working at a Hollywood studio at age 25. The studio’s retirement plan matches 50 cents for every dollar that an employee contributes to his or her account up to a maximum of 6% of his or her salary. While Jimmy and Karen each make $40,000 per year, Jimmy begins saving in the company plan right away and takes full advantage of the employee match of $1,200 per year for 40 years.

Karen, on the other hand, lives in the moment and decides to put off saving. She joins her 401(k) plan at 35 and contributes the maximum 6% of her salary—just as Jimmy had done 10 years earlier. However, Karen has just 30 years to build her nest egg.

Who do you think has more money at age 65? That’s right, Jimmy, by $600,194! Time to break out the champagne, Jimmy, for having the foresight to invest as early as possible!

2- Credit your paycheck and retirement plan as supporting actors. Pretax contributions from your paychecks are unseen, but they are vital players. Your plan makes it easy to contribute, stay invested and generate income2 once you retire and offers a range of investment options to meet your needs.

3- Ask your director for feedback. A financial advisor can be your director—helping put together a retirement income strategy that takes into account an appropriate balance of stocks, bonds and cash, relative to the risk you are willing to take on, and advising you on how much you can sensibly withdraw once you retire.

4- Keep a level head. Don’t invest all of your money in riskier stocks. Diversifying your retirement account may help cushion it from market downturns.3 You want to make sure you walk away with the Oscar, not empty-handed.

It takes a strong support team behind the winning actors to help them reach the Academy Awards stage. You are not alone in your retirement plans, either. See you at the after-party!

Credits…

1 Academy Awards®, Oscar® and the Oscars® are trademarks of the Academy of Motion Picture Arts and Sciences.

2 Withdrawals from qualified plans made prior to age 59½ may be subject to a 10% IRS penalty and income taxes.

3 Diversification does not guarantee a return or protect against losses.

Next Step: Request a free consultation

Disclosure: This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal or investment advice. LPL Financial and its advisors are providing educational services only and are not able to provide participants with investment advice specific to their particular needs. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material.

Kmotion, Inc., 412 Beavercreek Road, Suite 611, Oregon City, OR 97045; www.kmotion.com

© 2015 Kmotion, Inc. This newsletter is a publication of Kmotion, Inc., whose role is solely that of publisher. The articles and opinions in this newsletter are those of Kmotion. The articles and opinions are for general information only and are not intended to provide specific advice or recommendations for any individual. Nothing in this publication shall be construed as providing investment counseling or directing employees to participate in any investment program in any way. Please consult your financial advisor or other appropriate professional for further assistance with regard to your individual situation.

Tracking: 1-420105