COVID-19 has decimated global demand as lockdowns materially re-shaped consumer and business behavior. Even as states have begun to re-open, significant questions remain about how demand could recover. The May retail sales print provided one of the first glimpses of that answer, rising 17.7% month over month and marking the largest monthly gain since data began in 1992.

Pent-up demand and an added boost from government stimulus helped fuel such a large gain. Each category of the report was positive in May, indicating broad-based increased demand for goods. As demand post-lockdown shifted away from discretionary spending items such as clothing and electronics, that trend appears to be reversing, with clothing sales in particular growing 188% in May.

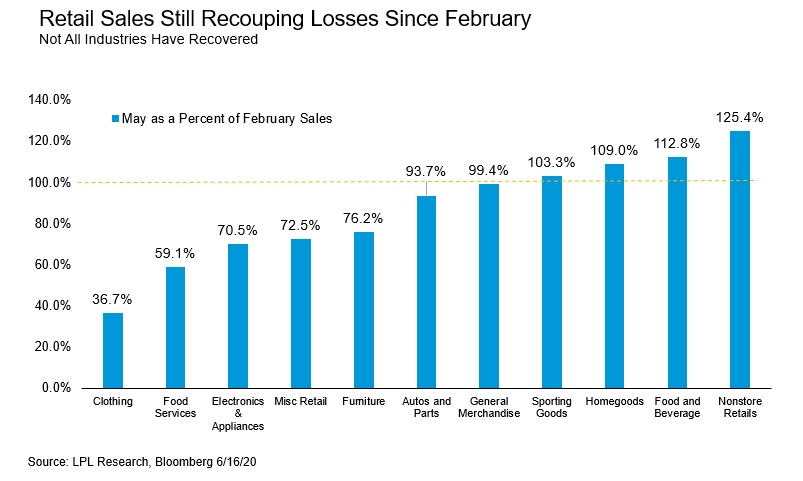

However, as shown in the LPL Chart of the Day, despite the strong growth in May, several industries in the retail sales report are still making up ground versus their pre-COVID-19 levels:

“Consumers appear to be ready to shop as states continue reopening. We’ll be watching to see if the retail sales rebound is a one-off or if it shows that consumer spending is returning to create a sustained trend,” said LPL Financial Senior Market Strategist Ryan Detrick.

Coming off the heels of the May nonfarm payrolls beat, the rebound in retail sales may prove to be the start of the return to normalcy for the US consumer, but both data points will need to show further stabilization before we can sound the all clear.

Do you have a written financial plan to pursue your financial goals? Set up a consult to get one soon…

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

If your representative is located at a bank or credit union, please note that the bank/credit union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL may also be employees of the bank/credit union.

These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, the bank/credit union. Securities and insurance offered through LPL or its affiliates are:

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use | Tracking # 1-05023380