As rate hikes increase, older Americans weigh dropping policies.

Eileen Cheng, 70, is holding on to the long term care insurance policy she purchased 15 years ago, even with an expected rate increase.

“If you’re buying it at 60, you may need it when you’re almost 80,” she said. “You don’t know what will happen in the future.”

Cheng isn’t alone. More than 7 million policies are in force today, though the industry is a far cry from its heyday in the 1990s. Back then, more than 100 insurers were in the business, which seeks to protect aging clients — and their assets — from a costly stay in a nursing or assisted living home.

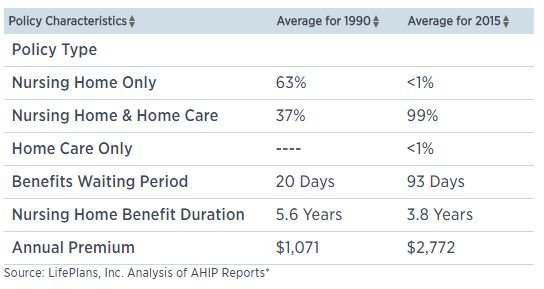

Today, the number of companies offering coverage is down to about a dozen. Low interest rates, lower-than-expected numbers of clients who drop their policies, and higher-than-predicted claims are to blame, said Scott Witt, a fee-only insurance financial advisor and founder of Witt Actuarial Services in New Berlin, Wisconsin. Clients who buy coverage today generally are also paying more for less generous benefits.

Here’s a comparison of policies from 1990 versus 2015:

Yet the question remains the same: Does it make sense to purchase long term care insurance?

Long Term Care – The rising cost of care

Regardless of how you pay for it, the care itself isn’t getting any cheaper.

The national median monthly cost of home health care and assisted living facilities is $3,861 and $3,628, respectively, according to Genworth Financial. See below for details on assisted living costs across the country.

Note that these two services are different than nursing home care, where patients generally require full-time supervision, plus room and board. The monthly national median cost of a private room at a nursing home is $7,698, according to Genworth.

Women tend to spend more time at a long-term care facility, according to data from the American Association for Long-Term Care Insurance. Women spend an average of 2.6 years in a nursing home, versus 2.3 years for men.

When solving the problem of paying for care, advisors point to three tiers of individuals and their finances.

“With $300,000 and less in assets, spend that money down and go to a state-covered program because you may not have the ability to buy coverage,” said Darin Shebesta, vice president at Jackson/Roskelley Wealth Advisors in Scottsdale, Arizona.

Medicaid, a state and federal health care program, can help pay for nursing home care, provided you have low income and generally less than $2,000 in assets.

“If you have $2 million and up in assets, there’s an argument for self-insuring,” Shebesta said. “You’re still a millionaire if you incur $250,000 in long-term care costs.”

As an alternative to using your assets to self-insure, consider a deferred income annuity to cover the cost of care in an advanced age. And, while you can’t deposit more money into your Health Savings Account (if you have one) after you’re on Medicare, you can still use any balances in the account for long-term care and other qualified medical expenses. Retirees who straddle that $300,000 to $2 million asset range are the ones who’ll lose a sizable chunk of money paying for care, and thus they’re the ones who may benefit most from a long-term care policy.

Risks abound – Long Term Care Insurance Policies

Advisors say that long term care insurance provides retirees some peace of mind in the event of a catastrophic health event. But bear in mind you are still subject to a number of risks if you buy a policy.

One is that the coverage doesn’t match the health issues that you’re facing.

“Everyone wants more coverage, more inflation protection and shorter wait periods,” Witt said. “Often, the premiums become prohibitively expensive, so people compromise.”

In that case, you wind up cutting your coverage too much by doing away with inflation protection or by using a benefit period that is too short.

Another risk is that you may spend decades paying into a policy and fail to use it at all.

“If they don’t use it, they lose it,” said Shebesta. “This turns clients off.” To address this issue, some insurers have launched “return of premium” riders for an additional cost.

Finally, if you buy coverage, you run the risk that your insurance company may raise the premium over time. Many individuals who bought policies in the 1990s have been subject to sharp rate increases as insurers raised their premiums to reflect the cost of unexpectedly high claims and low lapse rates.

Insurers considering a rate increase must get approval from state regulators. In turn, seniors are in a tight spot: They can pay for the rate increase, lower their benefits or let their coverage lapse.

“For some people, if they bought coverage at the right time, started collecting at the right time and didn’t live very long, then they might have had a good deal,” said Joseph M. Belth, professor emeritus of insurance in the Kelley School of Business at Indiana University.

“It’s conceivable that someone could believe they got a good deal, but my opinion is that people who rely on it will be disappointed,” he said.

Cheng has been through two rate increases. The first one raised her annual premiums from $1,154 to about $1,300, and the next one bumped the cost to $1,410. In all, her rates increased by approximately 30 percent.

She didn’t drop her policy. A major reason was that her late husband had used his coverage when he developed Parkinson’s disease and needed care in 2013. The policy covered a $10,000 chairlift at home as well as a benefit of $219 per day for home care.

The two purchased their policies at the encouragement of their daughter Rita Cheng, a certified financial planner and CEO of Blue Ocean Global Wealth in Rockville, Maryland.

“It’s worth spending the money because you have no idea how hard it is to care for someone,” Eileen Cheng said.

Long Term Care Policies – Acceptable costs and cuts

If you’re considering a long term care insurance purchase, Cheng’s daughter recommends viewing the policy as a way to cover a portion — but not all — of the cost of care. “See how much you can absorb,” she said. “That makes it a little more affordable.”

What if you already have coverage and you’re facing a rate hike? Cheng recommends the following steps:

- Call your insurer: If the cost of the coverage is going up by 25 percent, but you can afford only 10 percent, find out what that will get you. Get everything in writing.

- Consider freezing your current benefit to keep your premium costs low, rather than losing your coverage altogether.

- Know where to make tweaks. A modification to your daily or monthly benefit amount may be doable, as is switching your benefits’ inflation protection.

- Don’t cut your home care. Advisors say elderly clients prefer receiving care in the comfort and familiarity of their home.

Article originally appeared on CNBC

Next Step: Request a free consultation

Source/Disclaimer:

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which course of action may be appropriate for you, consult your financial advisor. This information is not intended to be a substitute for specific individualized tax or legal advice. We suggest that you discuss your specific situation with a qualified tax or legal advisor. LPL Financial representatives offer access to Trust Services through The Private Trust Company N.A., an affiliate of LPL Financial. This material has been prepared by LPL Financial., a registered investment advisor, member FINRA/SIPC. To the extent you are receiving investment advice from a separately registered independent investment advisor, please note that LPL Financial is not an affiliate of and makes no representation with respect to such entity. Not FDIC or NCUA/NCUSIF Insured | No Bank or Credit Union Guarantee | May Lose Value Not Guaranteed by any Government Agency | Not a Bank/Credit Union Deposit © 2014 LPL Financial LLC. All Rights Reserved. The information contained herein has been prepared by and is proprietary to LPL Financial. It may be shared via social media in the exact form provided, in its entirety, with this copyright notice. LPL Tracking #1-525827