Another wild week. The emotions are running high and that might cause you to make bad decisions about your money and your 401(k). In the last few days I’ve gotten calls asking:

- “What do I do now?” – Some clients want to cash out or move to a money market. If you do, when the market rebounds, you might miss out on upside gains and it’s going to take longer to get your account value back to where it was back in February. That’s another reason why over time most investors lag the market… they sell on the bottom and buy in when the market is back (that’s selling low and buying high). Is that what you really want?

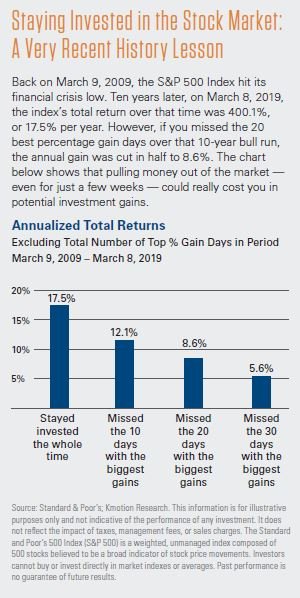

- “I’ll sell now and then get back in when it’s safe” – You’re assuming you are going to know when to get back in and that it’s going to be lower when you do. That is incredibly difficult to do. Good luck, you must have a crystal ball. See the chart below (Staying invested in the Stock Market)

- “What if the market goes to zero?” – While anything is possible, it would mean that the 500 largest companies in America went bankrupt. That list includes: Google, Amazon, American Airlines, Bank of America, Berkshire Hathaway (that’s Warren Buffet‘s company), Chevron, Coca-Cola, Microsoft, Apple, Visa, AT&T, Home Depot, Walmart… and 487 more!! If that happens we have some really big problems on our hands, wouldn’t you agree?

I care about you and truly want what is best for you. The market correction has already happened. There’s nothing you can do about it BUT here are 2 ideas you can take action on right now:

- Re-balance: Due to the market correction, your account is probably out of balance on the equity side (equities went down so you have less). Rebalance to increase your equities to the your original suitable allocation. The first reason is that you should always stay within the original suitable allocation because well, it’s the suitable allocation for you. The 2nd reason is that when the market rebounds you want to have the right equity exposure because that is where the rebound is going to be for the most part. (Good news: Target Date Funds do this automatically so you don’t have to worry about it. That’s another wonderful reason why Target Date Funds are such a compelling option for retirement investing and why I talk about them so much).

- Invest more, if you can afford to: This market correction is not going to last. Think about how bad 2008 and 2009 were. If you invested at the bottom of that market you would have had a 5x return on your money. Now I ask you “Knowing how the market recovered from then, how much would you have wanted to invest at the bottom?”. If you don’t have extra money set aside, consider bumping your 401k contribution 1% or 2%.

More explanation about Rebalancing: With stocks down 30%, your portfolio could be out of balance. For example, if your appropriate allocation is 80% equities and 20% fixed income and cash, right now you could be at 65% equities and 35% fixed income and cash. Think of it like a car getting out of alignment. The market correction is like hitting a pothole. The market correction has caused you to get out of balance.

More explanation about Rebalancing: With stocks down 30%, your portfolio could be out of balance. For example, if your appropriate allocation is 80% equities and 20% fixed income and cash, right now you could be at 65% equities and 35% fixed income and cash. Think of it like a car getting out of alignment. The market correction is like hitting a pothole. The market correction has caused you to get out of balance.

This is important. If you remain in your current allocation as markets recover, you won’t experience the same recovery in your account because you are out of balance (you own fewer equities). That is another reason why investors underperform the indexes. They are simply out of alignment.

When you design your account (asset allocation) you invest in asset classes according to a plan (how many years until retirement, risk tolerance, etc). Rebalancing helps you get back to that plan after hitting a pothole.

Be well. Contact me if you have any questions or concerns. I am always right here.

Next Step: Speak to a Financial Advisor

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Asset allocation does not ensure a profit or protect against a loss. All investing involves risk including the possible loss of principal. No strategy assures success or protects against loss. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss. The principal value of a target fund is not guaranteed at any time, including at the target date. The target date is the approximate date when investors plan to start withdrawing their money

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

For Public Use | Tracking # 1-972447