US and International Equities

The S&P 500 Index gave back some gains in September after a strong five-month run, with most sectors finishing in the red. The utilities and materials sectors were the exceptions, both gaining for the month. The sectors with the largest pullbacks this past month were energy, communication services, information technology, and consumer discretionary. Given the challenges with the technology sector, large growth underperformed large value. In addition, mid and small cap equities also lost ground this month.

International equities were also broadly lower, with both the MSCI EAFE and MSCI EM indexes both down this past month.

Fixed Income, Currencies, and Commodities

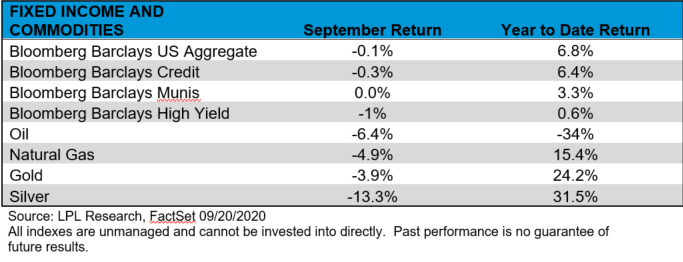

The bellwether Bloomberg Barclays US Aggregate Index finished the month very slightly lower and most major bond sectors fell. US Treasuries along with short-intermediate municipal bonds finished this past month in the green. Emerging markets debt as measured by the JP Morgan Emerging Markets Bond Index (EMBI) was among the weakest of the major bond sectors.

Commodities were broadly lower this month. Gold, silver, natural gas, and crude oil prices declined with silver down over 10%. The exception was copper, which saw a return of more than 1% this month.

US and International Economic Data Recap

The Federal Reserve communicated following its September meeting that it’s committed to continuing to use monetary policy tools to support the economic recovery. The Federal Open Market Committee (FOMC) stated that short-term rates would remain targeted at 0% to .25%. Rates could stay anchored near zero until 2023 or beyond unless inflation rises consistently.

The US unemployment rate remains high compared to history. COVID-19 has played an adverse role on service industry employment. Even though the unemployment rate has dropped to near 8% from a peak of approximately 15%, we are quite a ways from having an economy at full employment. The final eventual approval of a COVID-19 vaccine should help the service industry, and thus our employment landscape.

US consumer spending slowed in August mainly because extended unemployment benefits ended. August core retail sales fell .1% as well compared to an expected increase of .9%. Given that progress on additional stimulus legislation has stalled, September retail sales may show a decline, as they did in August.

Looking Ahead

The election is expected to be a major theme in October as Election Day approaches. In addition, we’ll start to receive corporate third quarter earnings. Market participants will be focused on forward guidance among concerns about the direction of the economic recovery.

Progress on a second round of stimulus, which has been viewed as a low-probability event by many investors, would be quite welcomed, and given the recent employment report, could be on the table. Any changes in the spread of COVID-19 as the weather gets colder will be monitored closely, while positive progress on a vaccine may be cheered by markets.

Do you have a written financial plan to grow your net worth and protect your retirement? Set up a consult to get a financial plan and advice you can understand.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

If your representative is located at a bank or credit union, please note that the bank/credit union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL may also be employees of the bank/credit union.

These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, the bank/credit union. Securities and insurance offered through LPL or its affiliates are:

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use | Tracking # 1-05063613