We continue to follow high-frequency data to assess whether the US recovery remains on track or if it has been derailed by COVID-19 outbreaks in parts of the country. Here we look at 5 charts that illustrate that the economic recovery remains on track and help explain why stocks continue to do so well despite such difficult economic conditions (we discussed that disconnect in our latest Weekly Market Commentary and on this week’s LPL Market Signals podcast).

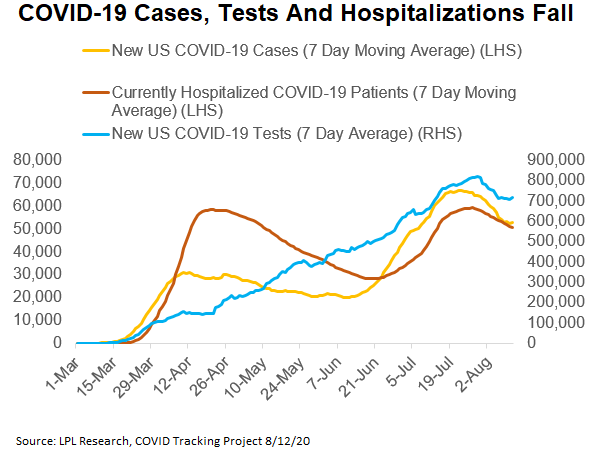

1) New COVID-19 cases and hospitalizations have fallen steadily in recent weeks. Of course we’d like these numbers to fall further but this progress is encouraging as some schools get ready to open—a potentially underrated factor for how the US economy performs this fall. This progress reduces the likelihood that lockdowns are reinstated while we wait for a medical breakthrough and supports the economic outlook.

2) Driving activity has risen further above pre-pandemic levels. Part of this story is seasonal, but the recovery in driving activity based on map requests from Apple is impressive. People moving around rather than stuck at home is generally good for economic activity, even if many of these map requests are vacation related rather than trips to the store, the office, or a manufacturing facility (few of us need gps to find those places).

3) Restaurant dining resumes its uptrend. It was not particularly surprising to see the number of people eating at restaurants drop in June when cases started to rise in many parts of the West and South. The good news is dining numbers nationally are back on the rise again, a sign that more consumers are increasingly confident that it’s safe to go out. With many restaurants limited to 50% capacity, a 55% year-over-year drop in seated diners with a positive trend is a good sign.

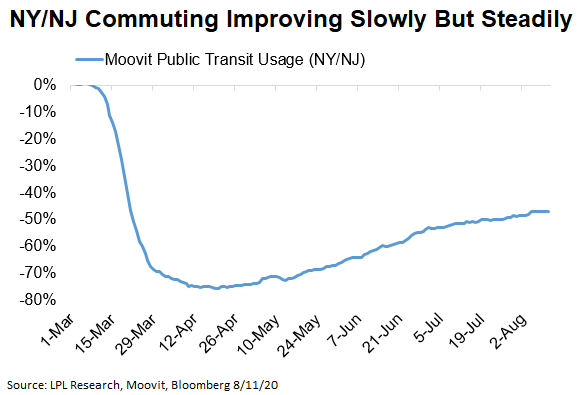

4) Commuting activity is on the rise. More people are heading back to work based on public transit usage in the New York-New Jersey metro area. We observe similar trends in Chicago and Los Angeles. Although the upward trajectory in these statistics have leveled off some recently, this is yet another sign that people are more comfortable getting out and are increasingly supporting the economic recovery.

5) Earnings estimates are rising. The upside surprises during the nearly-complete second quarter earnings season have been very impressive, averaging 22%, even though S&P 500 earnings are tracking toward a more than 30% year-over-year decline for the quarter. Perhaps even more impressive is that earnings estimates for the next 12 months have risen during earnings reporting season, an unusual occurrence. Higher estimates bode well for the earnings outlook and were part of the reason LPL Research increased its 2020 earnings-per-share estimate for the S&P 500 to $125-$130, up from $120-$125.

“The high-frequency data that leveled off early this summer has started to turn higher recently,” said LPL Financial Equity Strategist Jeffrey Buchbinder. “More people getting out as COVID-19 cases have fallen suggests the economic recovery may be picking up a little bit of speed. Maybe the disconnect between the stock market and the economy is not quite as wide as we thought.”

The improvement in jobless claims reported this morning also supports the notion that the recovery is continuing to chug along, although the recovery of lost US output may take another year or two.

Do you have a written financial plan to grow your net worth and protect your retirement? Set up a consult to get a financial plan and advice you can understand.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

If your representative is located at a bank or credit union, please note that the bank/credit union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL may also be employees of the bank/credit union.

These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, the bank/credit union. Securities and insurance offered through LPL or its affiliates are:

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use | Tracking # 1-05044036