Our Financial Advisors in Santa Clarita provide Wealth Management and Financial Planning services to select families, business owners and professional entertainers and athletes. Our Financial Advisors in Southern California are experts in helping individuals and businesses with financial planning and investment advice. Clients benefit from our financial advice in not only protecting their financial assets but growing them over time with our unique Advance and Protect Financial Strategies.

Our Private Wealth Management services for high net worth individuals encompassing financial planning, estate planning and tax strategies.

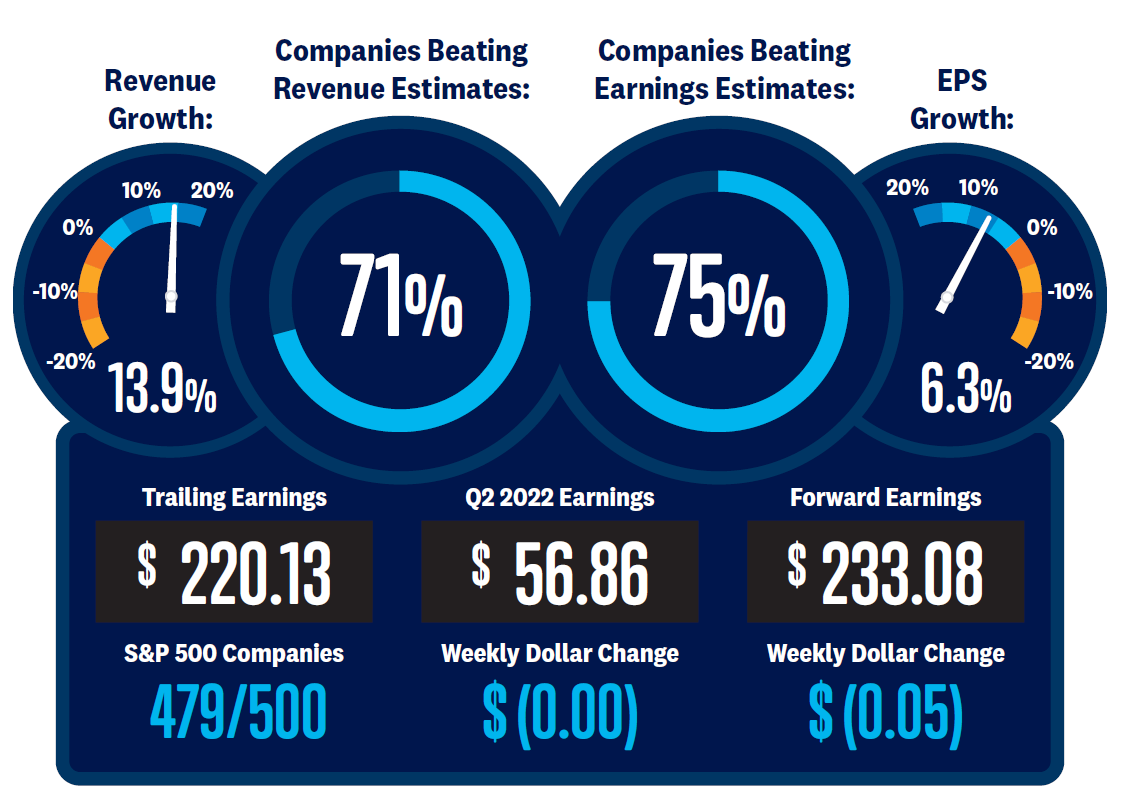

Taking Stock of Uncertain Markets

Erick Arndt2022-10-14T11:27:02-07:00In the last several weeks, we have continued to face elevated uncertainty in financial markets due to high inflation and rising interest rates, and we thought it was an important time to take stock with the final quarter of 2022 just ahead. It has been a difficult year, not only for investors but also [...]