Market Performance Remains a Tale of Haves and Have-Nots

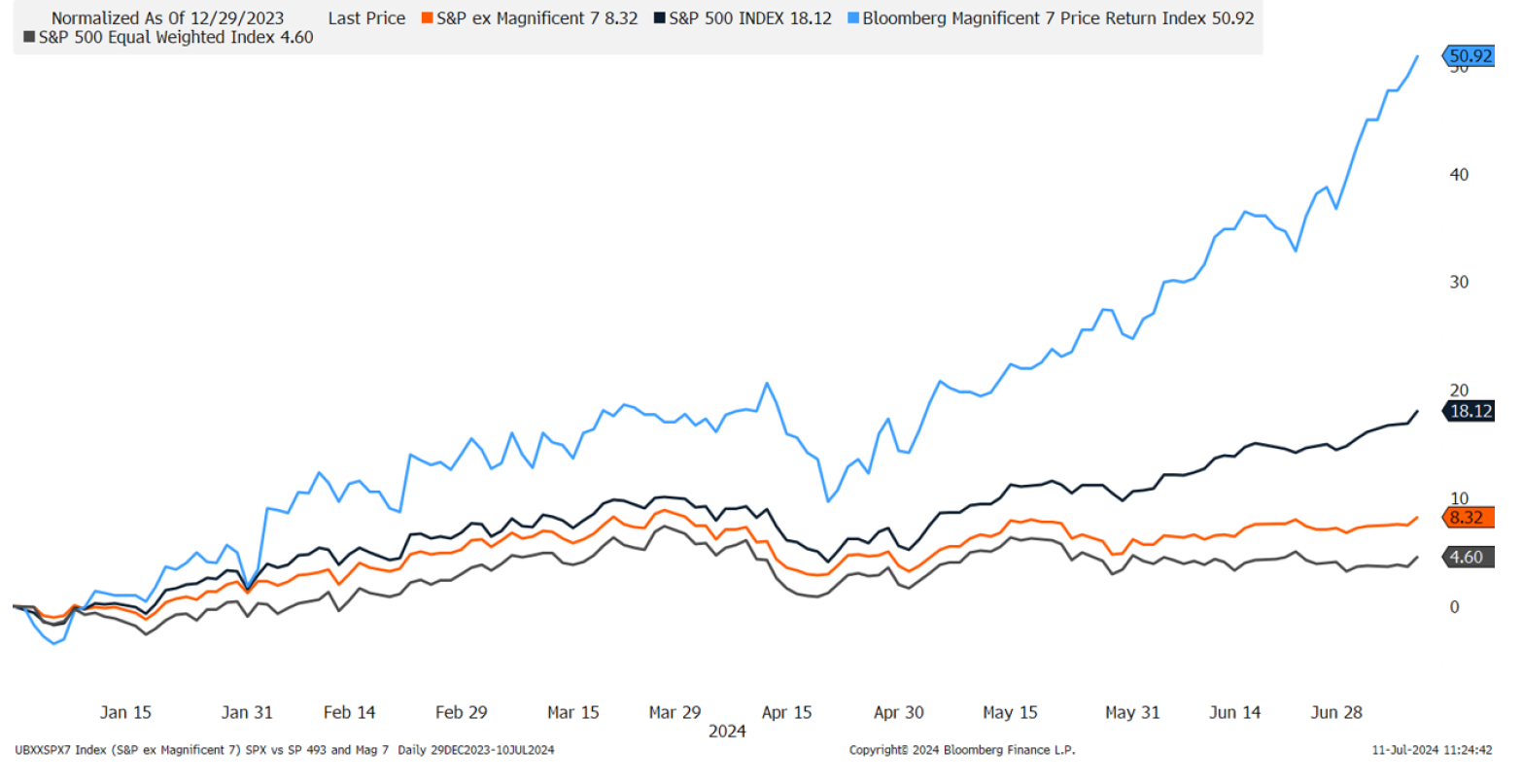

Erick Arndt2024-07-17T15:26:44-07:00The S&P 500 strung together 37 record highs this year aboard an 18.1% rally, as of July 10. The advance has largely been powered by a handful of mega cap names tied to technology and/or artificial intelligence. In fact, six stocks — NVIDIA (NVDA), Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Meta (META), and Alphabet [...]

We provide expert investment commentary on world markets from our internal investment analysts at LPL Financial. This expertise is for our financial advisors and clients in Santa Clarita and throughout Southern California as well as MA, NH, and FL.