As 2020 winds down, it has been an extremely tough year on all of us. Still, there are many reasons to be thankful and today we will share some reasons investors should be thankful.

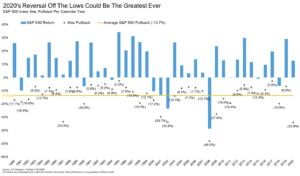

Stocks have had one of the largest reversals ever in 2020, something to be thankful for. In fact, this could be the first year ever to see the S&P 500 down more than 30% peak-to-trough and finish higher.

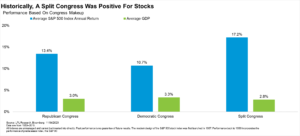

We should also be thankful that Congress was split in 2020, likely marking the 11th consecutive year the S&P 500 gained under a split Congress. Gridlock is good they tell us and that very well could be true yet again.

Want something else to be thankful for? We likely will have a split Congress for another two years after the two Georgia runoffs are official.

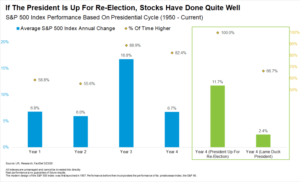

Let’s be thankful that it is looking like stocks once again will be higher the year a President is up for re-election. In fact, you have to go back to FDR in the ‘40s the last time the S&P 500 was lower for the year when a President was up for re-election.

Let’s be thankful that the fastest bear market in history (only 16 days) is officially a thing of the past.

We are thankful that we are in a new bull market, which if history plays out once again, could have a lot of life left to it. In fact, the average bull market has lasted more than five years.

“Let’s be thankful that the huge move off the March lows was a major clue of more strength,” explained LPL Financial Chief Market Strategist Ryan Detrick. “We noted at the time (many different ways) that the enormous move we saw off the March lows likely suggested significantly higher prices, while many ignored the market signals and instead looked for a re-test for months on end.”

The 20-days off the March lows was the second best 20-day rally ever and sure enough, the returns have been very strong.

We are finally seeing many stocks participate in this bull market, another reason to be thankful. In fact, the Value Line Arithmetic Index recently made new all-time highs. This index is a great look at what the ‘average’ stock is doing and is a sign that this move isn’t being led by just a few large cap tech stocks.

Let’s be thankful that the NYSE Cumulative Advance/Decline line is at new highs. This looks at how many stocks are going up versus down and new highs are a sign of very healthy participation.

Emerging markets have started to turn higher and we are thankful that this group could be on the verge of a major breakout to new highs, clearing their peak from 2007. As we move into ’21, this is one group we think could continue to do quite well for investors.

Global investors should be thankful, as the MSCI Global Index broke out to new highs as well, suggesting this rally isn’t only about the US anymore.

We upgraded our view on small caps in September and the Russell 2000 Index is currently on pace to have its best monthly return ever. Investors should be thankful that this group is finally participating, as there are many more small caps than large caps, another sign of improving breadth, while small caps are also more domestic by nature and could be suggesting a strong US economy next year.

Investors should be thankful for the incredible strength around the election, as the S&P 500 gained more than 1% four consecutive days. This is extremely rare, yet, extremely bullish going out a year.

As we showed in Frothy Sentiment Rides Bullish Technicals, the huge number of stocks in the S&P 500 making new monthly highs should make bulls quite thankful.

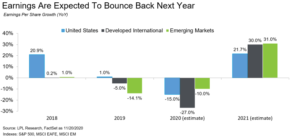

Earnings are expected to see a major bounce back, as the global economy gets back online next year, making many investors quite thankful.

Economic forecasts may not develop as predicted.

The final reason to be thankful? Dow at 30,000!

Do you have a written financial plan to grow your net worth and protect your retirement? Set up a consult to get a financial plan and advice you can understand.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

If your representative is located at a bank or credit union, please note that the bank/credit union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL may also be employees of the bank/credit union.

These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, the bank/credit union. Securities and insurance offered through LPL or its affiliates are:

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use | Tracking # 1-05076766