This isn’t like any recession we’ve ever seen, as it was sparked by a horrible pandemic and happened because people were told to stay inside. The impact was the worst contraction in gross domestic product (GDP) last quarter that anyone who is reading this has ever seen.

But what is quite surprising is the fact the Nasdaq has made 30 all-time highs so far in 2020, while the S&P 500 Index has gained four consecutive months, all while the unemployment rate remains above 10%.

Why is this happening? There are two main schools of thought. One is that stocks are forecasting a better economy later this year and into 2021; remember, stocks tend to lead the economy and could be doing so once again. Another school of thought is that the massive fiscal and monetary policy are boosting equity prices, while not helping the overall economy quite as much.

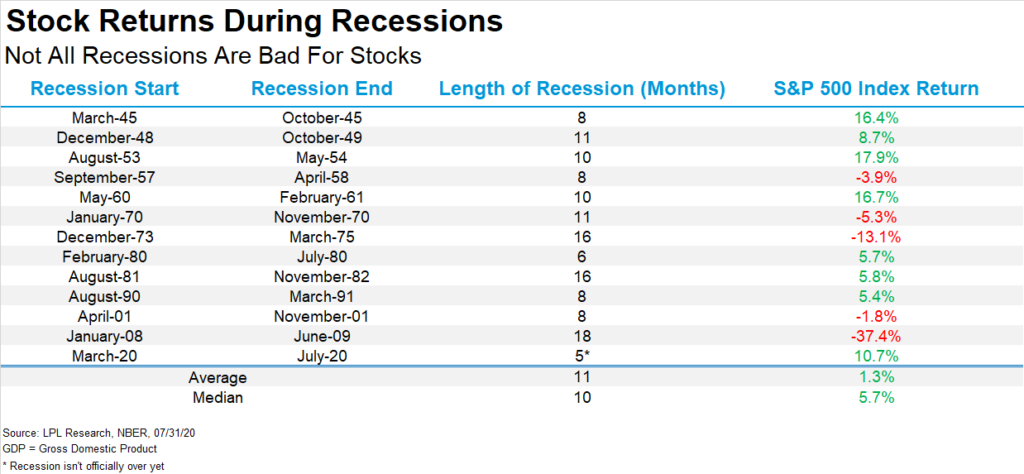

Here’s the catch. It actually isn’t abnormal to see stocks gain during a recession. “This is one that might surprise many people, but stocks have actually gained during 7 of the past 12 recessions,” explained LPL Financial Chief Market Strategist Ryan Detrick. “There’s no question the difference between what is happening on Wall Street compared with Main Street is about as wide as we’ve ever seen, but maybe it shouldn’t be as big of a surprise that stocks have been strong.”

As shown in the LPL Chart of the Day, the S&P 500 actually gained 1.3% on average when looking at the 12 previous recessions going back to World War II, with a very impressive median advance of 5.7% (the average is skewed lower due to 2008). We continue to expect this recession to end soon, if it isn’t over already. In fact, when the end of the recession is officially declared at a later date, we could have yet another recession that saw stock market gains.

Do you have a written financial plan to grow your net worth and protect your retirement? Set up a consult to get a financial plan and advice you can understand.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

If your representative is located at a bank or credit union, please note that the bank/credit union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL may also be employees of the bank/credit union.

These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, the bank/credit union. Securities and insurance offered through LPL or its affiliates are:

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use | Tracking # 1-05040742