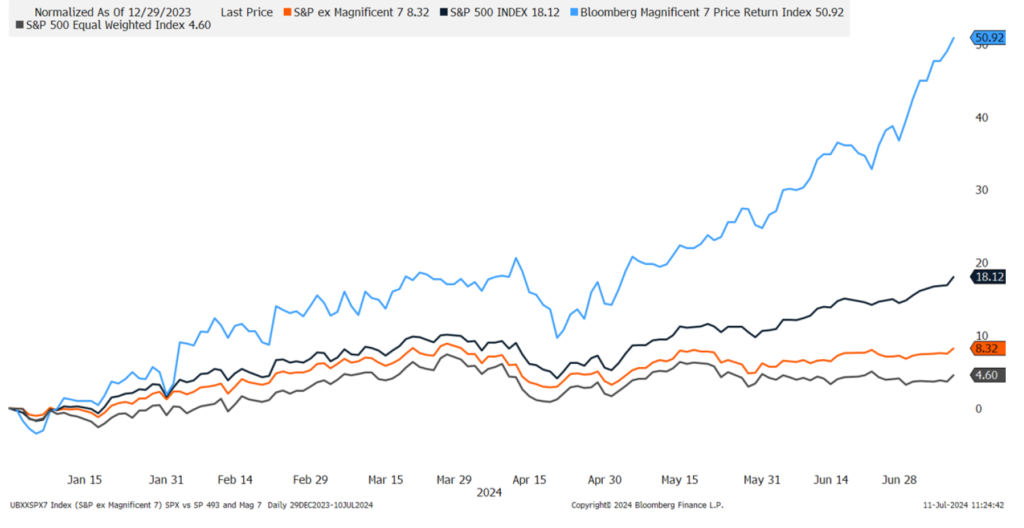

The S&P 500 strung together 37 record highs this year aboard an 18.1% rally, as of July 10. The advance has largely been

powered by a handful of mega cap names tied to technology and/or artificial intelligence. In fact, six stocks — NVIDIA (NVDA),

Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Meta (META), and Alphabet (GOOG/L) — are responsible for nearly twothirds

of the S&P 500’s total return this year. As highlighted in the chart below, the Magnificent Seven, which adds Tesla

(TSLA) to the aforementioned six stocks, is up 51% on an equal weight basis. Without these seven stocks, the S&P 493 (ex

Magnificent Seven) would only be up 8.3%.

For the rest of the market, performance has been positive but not nearly as exciting. The average stock, proxied by the equal

weight S&P 500, is up only 4.6% this year, underperforming the cap-weighted S&P 500 by 13.5%, marking the largest delta

since 1998.

Returns Remain Bifurcated Between Mega Caps and the Average S&P500 Stock

Source: LPL Research, Bloomberg 07/10/24

Disclosures: Past performance is no guarantee of future results. All indexes are unmanaged and can’t be invested in directly.

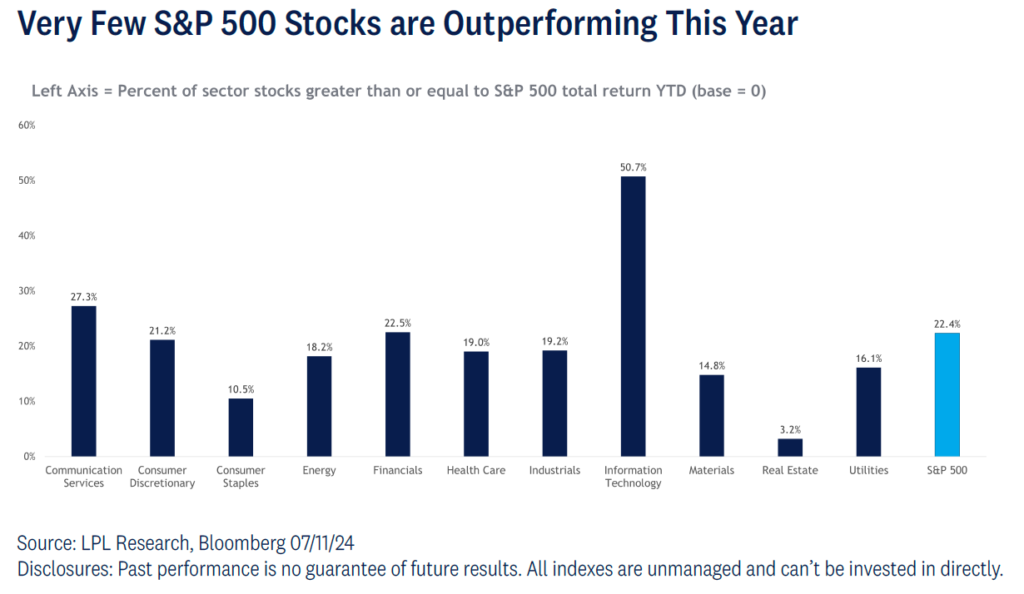

Limited participation in the latest leg higher for the broader market has created notable divergences between price and a longlist of breadth metrics. Divergences can often be temporary and do not imply the bull market run is over. However, they doserve as a warning sign for a potentially weakening rally and trend reversal. One of the many ways to measure the internal strength of the market is to analyze how many stocks within an index are actually outperforming, along with what sectors areleading or lagging. The table below highlights how many stocks within the S&P 500 are beating the index this year, also broken down by sector. At a high level, fewer than 25% of S&P 500 stocks are outperforming this year. Technology has dominated at the sector level,but only half of the stocks are beating the tape. While tech sector leadership is welcomed, the lack of other cyclical stocks out performing is a concern, although notable underperformance in consumer staples, real estate, and utilities helps alleviate concerns over a shift toward defensive leadership.

Summary

The S&P 500 remains in a bull market and above its longer-term uptrend. However, overbought conditions paired with overhead resistance and diverging breadth point to growing risk for a pullback over the near term. The dwindling list of new highs among S&P 500 constituents, a diverging advance-decline line, underwhelming volume, and extremely overbought conditions in technology and semiconductors add to the evidence this rally could be due for a breather. This does not denote a shift in our confidence in the longer-term bull market, and as a reminder, a 10% drawdown during the second half would align with historical trends for the S&P 500. Based on this backdrop, we recommend a neutral equities allocation and tactically buying dips over chasing the latest rally.

Take action: Schedule a consultation to determine if this sunset will affect your estate and your heirs.

Book a free consultation

Disclosures:

This material is for general information only and is not intended to provide specifi c advice or recommendations forany individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your fi nancial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of theperformance of any investment and does not refl ect fees, expenses, or sales charges. All performance referenced ishistorical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; howeverLPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and fi rms mentioned are not affi liates of eachother and make no representation with respect to each other. Any company names noted herein are foreducational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fl uctuation and political instability and may not besuitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior tomaturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-freebut other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interestrate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging theinvestment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategiesemployed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higherinterest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of adiversifi ed portfolio for sophisticated investors.

Precious metal investing involves greater fl uctuation and potential for losses.

The fast price swings of commodities will result in signifi cant volatility in an investor’s holdings.

Securities and advisory services off ered through LPL Financial, a registered investment advisor and broker-dealer.Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | NotBank/Credit Union Guaranteed | May Lose Value

Tracking #601944