With longer life spans come extended healthcare needs — and significantly more dollars required to pay for them

It’s more likely today that you’ll live longer than your grandparents did. The flip side is that you may spend far more on doctors’ bills and treatment for chronic illnesses than previous generations. With healthcare costs continuing to rise along with life expectancies, health savings accounts (HSAs) are an increasingly popular way to bridge the retirement and health savings gap.

It’s more likely today that you’ll live longer than your grandparents did. The flip side is that you may spend far more on doctors’ bills and treatment for chronic illnesses than previous generations. With healthcare costs continuing to rise along with life expectancies, health savings accounts (HSAs) are an increasingly popular way to bridge the retirement and health savings gap.

Most retirees are underfunding their future healthcare needs

It’s very difficult to visualize a future unknown such as healthcare expenses — let alone set aside money to pay for them. But according to a 2019 research report,1 a 65-year-old couple retiring today will need $360,000 to cover their total lifetime healthcare costs. Plus, while 70% of Americans age 65 or older will need some form of long-term care during their lives, only 17% are very or extremely confident that they’ll have the resources to pay for it.2 And the numbers suggest a growing funding crisis: according to HSA Bank, 40% of consumers never set aside money specifically for future healthcare costs.3

$245/day: Average cost of semiprivate room in a nursing home in 20184

An HSA complements your retirement plan

The key with any large expense is to break it down into manageable chunks. Just as your retirement plan takes manageable amounts out of your paycheck each month, you can use an HSA to pay for future healthcare expenses by making small, regular deposits. An HSA is a hybrid savings and investment account that lets you set aside funds in a tax-advantaged way, and allows you to:

- Pay for Medicare premiums on a tax-qualified basis, meaning that your contributions are taken from your paycheck before taxes are taken out

- Pay for qualified long-term care insurance premiums tax-free

- Reimburse yourself for qualified medical expenses at any time, with tax-free withdrawals

- Avoid taking required minimum distributions at age 70½

- Set aside funds that are not factored into income for Medicare means testing.

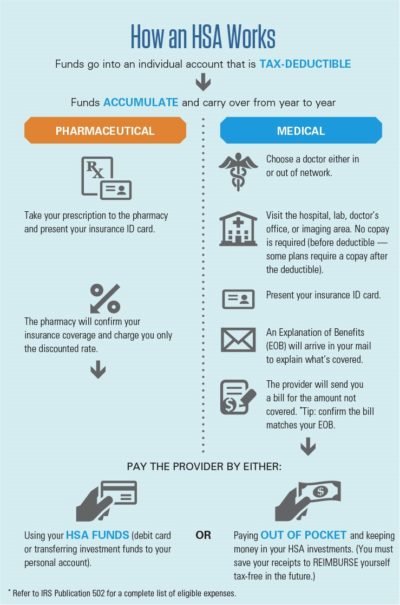

How HSAs work5

An HSA allows you to lower your federal income tax bill by making tax-free deposits each year. In order to contribute to an HSA, you must be enrolled in a high-deductible health insurance policy (HDHP), either through your employer or on your own. In 2020, the Internal Revenue Service has set minimum deductibility limits for HDHPs of $1,400 for individuals and $2,800 for families. You can’t be covered by another person’s health plan, and your income isn’t a factor in your eligibility.

The amount you contribute to your account can be invested in basic interest-bearing accounts or funds, and the amounts deposited along with any earnings can be withdrawn tax-free at any time to pay for qualified medical expenses not covered by your HDHP. (Qualified expenses include items such as dental and vision costs, as well as preventive medications, such as sunscreen, bandages, and lip balm, among others.)

You must stop contributing to an HSA once you enroll in Medicare.

If you withdraw funds from an HSA and don’t use them to pay for qualified medical expenses and you’re under age 65, you’ll have to pay tax on the full withdrawal amount plus a 20% penalty (so don’t do it unless you have a big emergency!) When you reach age 65, you’re allowed to draw from any unspent HSA funds without taxes or penalty if you use them for medical expenses. Unused HSA funds roll from year to year — and your account has the potential to grow until you take future withdrawals — which makes them a useful complement to your retirement plan.6

You can also use your HSA to pay for medical expenses of a spouse or other family member — even if they are not covered by your health insurance. If your employer offers an HSA, you can take your account with you when you retire or change jobs.

If you’re healthy and don’t anticipate having much in the way of medical expenses as you get older, an HSA can be an excellent long-term tax-advantaged investment. But if you wind up needing long-term care not covered by Medicare, a well-funded HSA may be able to fill any short-term funding gap — giving you and your loved ones peace of mind.

Next Step: Speak to Erick, a 401(k) Advisor

Sources/Disclaimers:

- “HealthView Services 2019 Retirement Healthcare Costs Data Report.” HealthView Services. 2019. http://www.hvsfinancial.com/wp-content/uploads/2018/09/2018-Retirement-Health-Care-Costs-Data-Report.pdf

- “Long-term Care in America: Increasing Access to Care,” Associated Press-NORC Center for Public Affairs 2018 Long-term Care Poll. https://www.longtermcarepoll.org/project/long-term-care-in-america-increasing-access-to-care/

- “HSA Bank Health and Wealth IndexSM.” HSA Bank. March 19, 2019. http://www.hsabank.com/hsabank/learning-center

- “Nursing Home Costs,” seniorliving.org., Aug.13, 2019. https://www.seniorliving.org/nursing-homes/costs/

- “How a health savings account (HSA) works,” healthinsurance.org, Feb. 21, 2019. https://www.healthinsurance.org/other-coverage/how-a-health-savings-account-hsa-works/

- “Top 10 reasons to use health insurance accounts,” healthinsurance.org., July 20, 2019. https://www.healthinsurance.org/other-coverage/top-10-reasons-to-use-health-savings-accounts/

This material was created for educational and informational purposes only and is not intended as ERISA, tax, legal or investment advice. If you are seeking investment advice specific to your needs, such advice services must be obtained on your own separate from this educational material.

Kmotion, Inc., 412 Beavercreek Road, Suite 611, Oregon City, OR 97045; www.kmotion.com

© 2019 Kmotion, Inc. This newsletter is a publication of Kmotion, Inc., whose role is solely that of publisher. The articles and opinions in this newsletter are those of Kmotion. The articles and opinions are for general information only and are not intended to provide specific advice or recommendations for any individual. Nothing in this publication shall be construed as providing investment counseling or directing employees to participate in any investment program in any way. Please consult your financial advisor or other appropriate professional for further assistance with regard to your individual situation.

Tracking #1-890238