Key Takeaways

- Inflation expectations over the next 12 months have convincingly improved, giving the Federal Reserve (Fed) reasons to pivot. We will likely notice improving inflation dynamics later this week.

- Risk appetite improved as investors considered bringing cash off the sidelines and into capital markets, pushing the markets to new all-time highs.

- Building permits, a leading indicator of future construction, accelerated in December as builders expect the housing market to improve as borrowing costs fall.

- The American Staffing Association’s staffing index hints at a softer-than-expected payroll print for the upcoming month.

To Cut or Not to Cut

As investors discuss the possibility of the Fed cutting rates in March and the extent to which the Fed is willing to acknowledge these cuts, here are a few significant charts to consider.

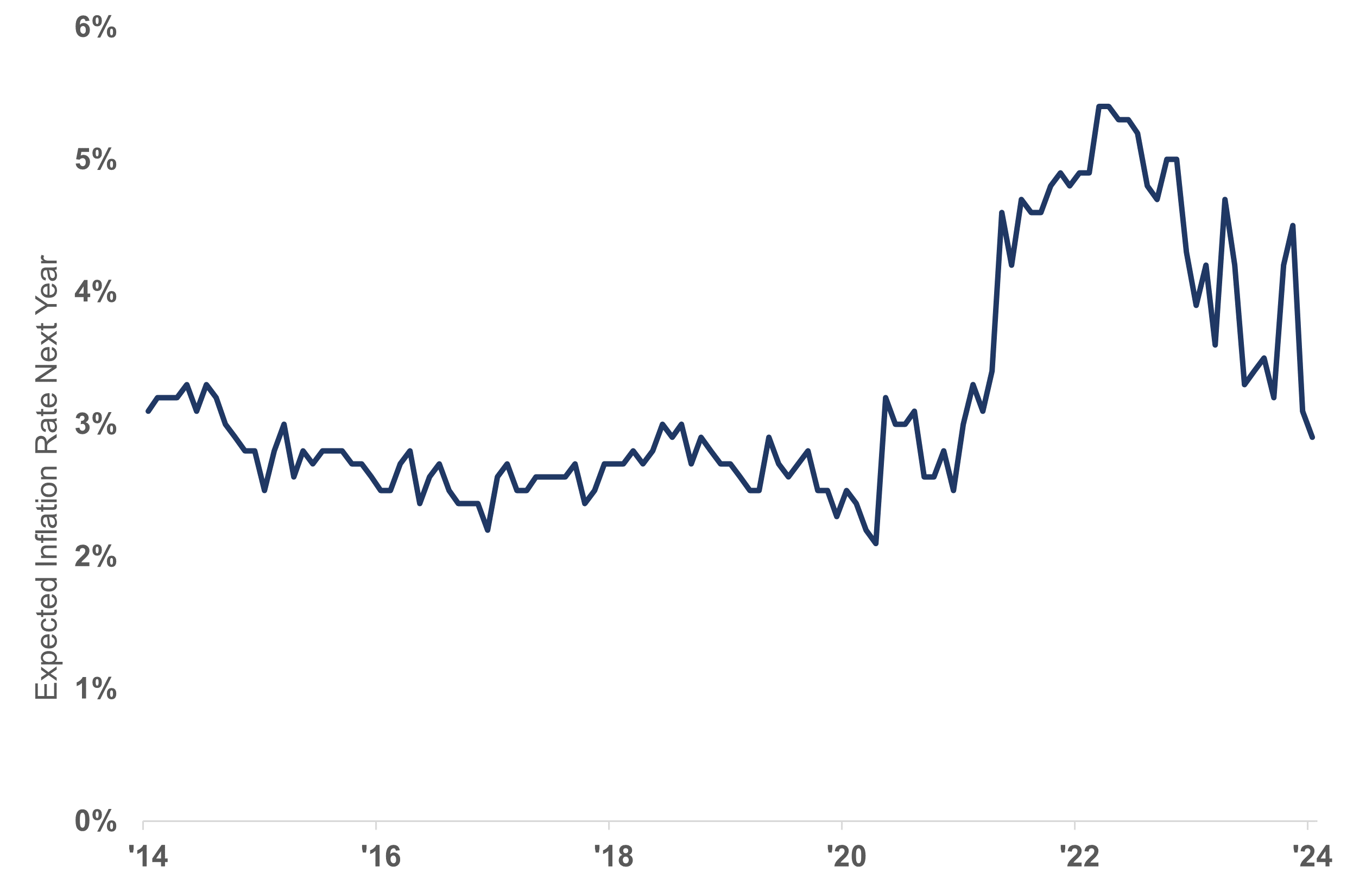

According to the University of Michigan survey, inflation expectations for the next 12 months dipped to 2.9%, the lowest since the end of 2020. As illustrated in the first chart below, the decline in inflation expectations is certainly good news for the Fed. Inflation expectations over the next 12 months have convincingly improved, giving the Fed the opportunity to cut rates as early as March but only if other data comes in weaker. Clearly, risk appetite improved as investors considered bringing cash off the sidelines and into capital markets.

Markets Recently Buoyed by Falling Inflation Expectations

Source: LPL Research, University of Michigan, 01/24/24

Residential Investment Supporting Growth

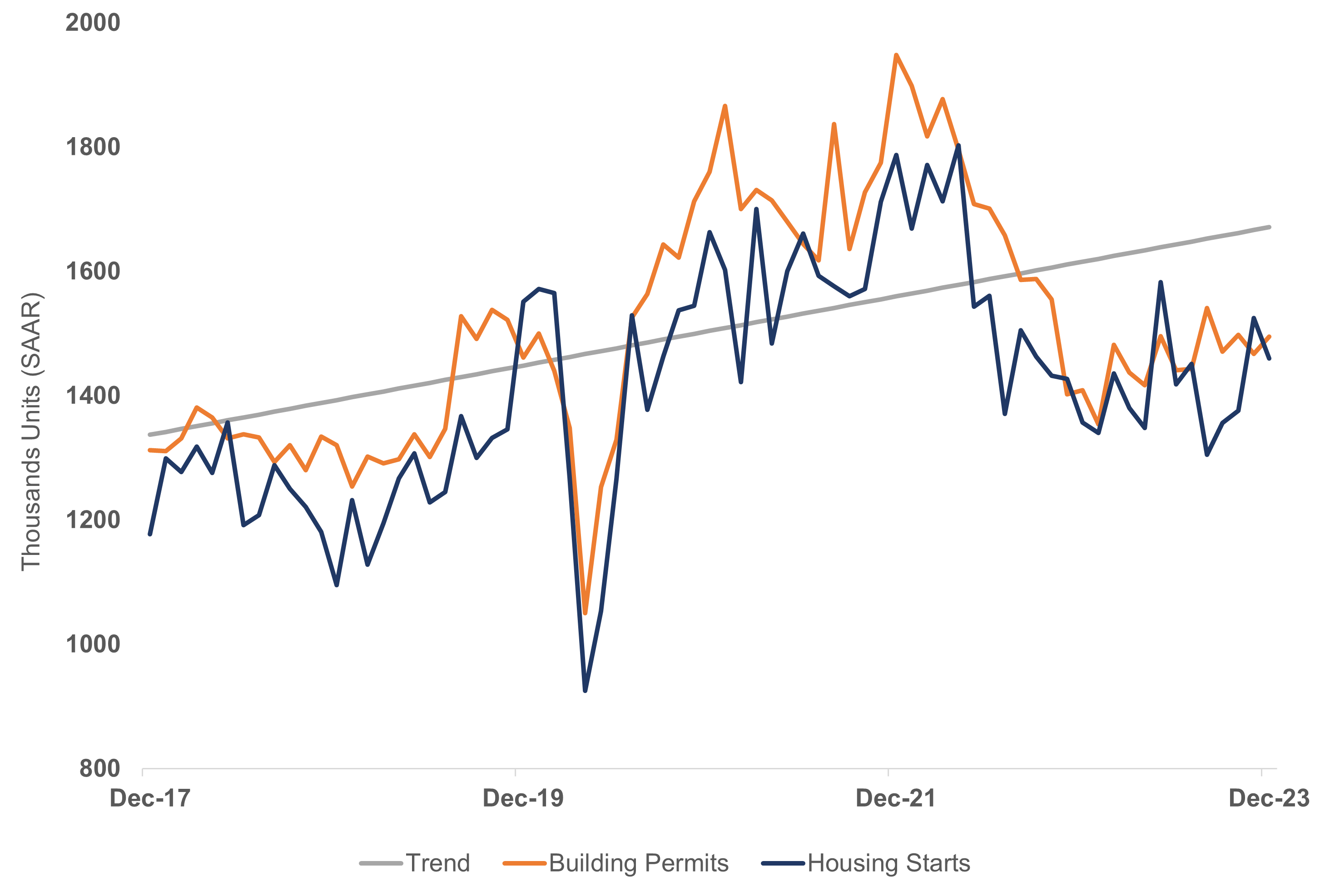

The consumer is not the only factor supporting economic growth. Construction activity is also providing a boost. Building permits, a leading indicator of future construction, accelerated in December as builders expect the housing market to improve as borrowing costs fall.

Falling mortgage rates should help demand for housing in the coming months. Despite the month-over-month decline in December starts, construction activity remains close to pre-pandemic levels. The low supply of existing homes on the market is nudging potential buyers to new construction. Despite Fed Chairman Jerome Powell’s warning, as the Fed embarked on its rate-hiking campaign of necessary pain, the economy seems to have managed to avoid significant pain, at least for now.

Construction Activity Should Improve This Year

Source: LPL Research, University of Michigan, 01/24/24

What Could Push the Fed to a Rate Cut

As illustrated above, the Fed has not inflicted much pain on the economy from its aggressive rate-hiking campaign to quell inflation. The mission is certainly not accomplished, which is why the Fed has not been too inclined to cut rates.

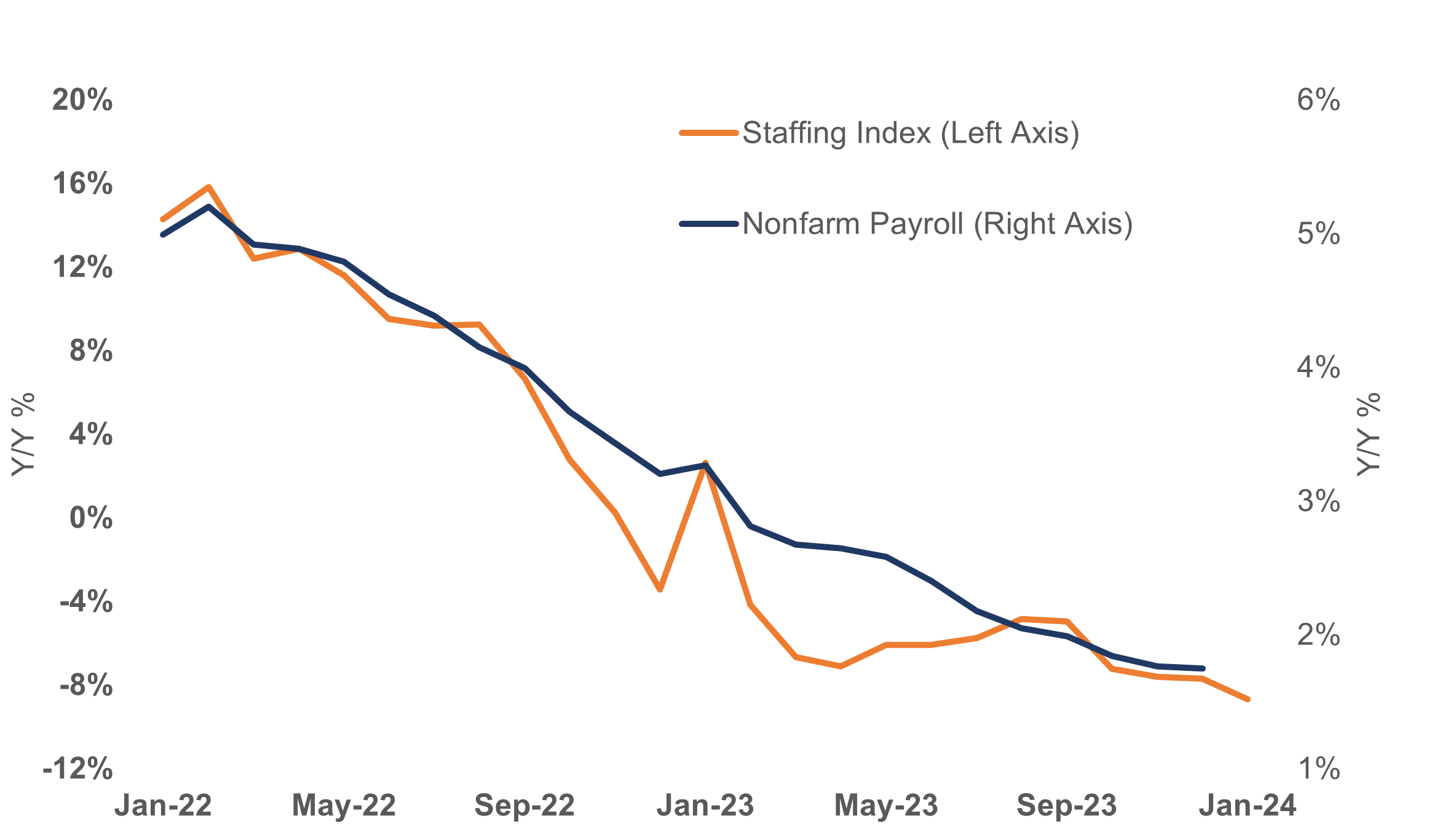

The sector that will likely determine the timing and magnitude of rate cuts is the job market. From the recent Institute of Supply Management (ISM) and National Federation of Independent Business (NFIB) survey data, businesses will likely slow the pace of hiring this year. So far, the pace of hiring has slowed but not alarmingly so. Wage growth has finally leveled up to where consumer prices are, which has helped consumer spending. However, investors should track the weekly staffing index from the American Staffing Association, which hints at a softer-than-expected payroll print for the upcoming month.

Job Growth Will Likely Slow Further

Source: LPL Research, American Staffing Association, Bureau of Labor Statistics, 01/24/24

Looking Ahead

Investors will likely focus on labor data to understand when and how the Fed might manage 2024. Currently, unemployment claims are low and layoff announcements are not causing concern, despite a few notable layoffs being reported in recent weeks. Since inflation trends are behaving nicely, markets will be closely watching how businesses plan to manage payrolls and any surprises in the job market could ignite some volatility.

Book a free consultation today to learn more.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor’s holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

For Public Use – Tracking: #532068