It’s tempting to predict runaway 1970s inflation as an April Fools’ Day joke. But at the risk of upsetting our friends in the compliance department, we’ll shoot straight here. With that important disclaimer out of the way, here we provide 10 reasons why we aren’t worried about inflation long term:

- Technological development. As we learned in our economics 101 textbooks, prices for goods and services tend to be tied to their marginal costs. As technological development continues at a rapid pace, costs to produce and distribute goods and services should continue to fall, putting downward pressure on prices.

- Globalization. One of the reasons inflation has been well contained in recent decades is access to cheaper labor and manufacturing capacity in developing nations. Although political pressure to diversify away from China is intensifying, plenty of alternatives still exist—Vietnam, India, and Mexico, just to name a few.

- Price transparency. Sometimes called the “Amazon effect,” consumers and businesses have never had an easier time comparison-shopping. The price transparency e-commerce provides has made it much more difficult for price increases to stick.

- Labor substitution. Labor is the biggest piece of the inflation puzzle because it is such a large part of companies’ costs. As a result, when companies have the ability to replace labor with cheaper machines, employees have less leverage for more pay. Labor unions also wield less power today than they did decades ago, which hurts collective bargaining power.

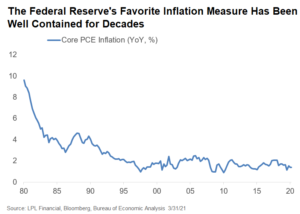

- Anchored inflation expectations. The trend is your friend as they say. Because prices have risen at such a modest pace over the past two decades, people have come to expect modest price increases and pushed back against anything more. Call it a self-fulfilling prophecy.

- Fed credibility. Federal Reserve (Fed) Chair Paul Volcker famously broke the back of inflation in the early 1980s. Since then, the Fed has effectively won this battle—even if they lost some credibility by overshooting with their inflation forecasts during the last cycle. There are doubters, but we believe the Fed will be to able keep inflation under control.

- It’s a show me story. Even the Fed was surprised at how little inflation the US economy generated during the last economic expansion (2009-2020). The Fed’s preferred inflation measure—the core personal consumption expenditures (PCE) index, excluding food and energy—rose at an average pace of just 1.6% during the last expansion (2009-2020) and 1.8% during the 2000s. Japan’s central bank has been trying to create inflation for several decades and failed. We’ll believe it when we see it.

- Low interest rates. It’s tough for equity investors to admit this, but the bond market has historically been a pretty good predictor of long-term economic trends. Historically, until the last decade or so, economic growth plus inflation had followed a similar path as long-term interest rates. We believe still-low long-term interest rates reflect the market’s expectation that inflation will remain contained over the long term.

- Demographics. The aging of the baby boomers has put downward pressure on economic growth and inflation. The rise of the millennials may begin to reverse that trend in coming years but that is still a long ways off in our view. High debt levels may crowd out demand and investment, reducing inflationary pressures.

- Link between money supply growth and inflation appears to be broken. Money supply, as measured by M2, has surged by an unprecedented 25% during the pandemic, leaving many to wonder why that extra money sloshing around from the Fed’s “money printing” hasn’t shown up in the inflation data. If that cash sits in consumer and business bank accounts, it doesn’t do much for growth or inflation. Until the funds are put to work and increase the velocity of money (a measure of the rate at which money is exchanged in the economy), inflation will remain subdued. We’ll call this another show me story.

Do you have our 2021 Market Outlook? Request it free!

Book a consultation or contact us today.

Book a consultation or contact us today.

Our 2021 Market Outlook is here! What does the stock market in 2021 have in store for us? 2021 will bring advances to further limit the impact of COVID-19, and the goal remains keeping the economy as open as possible until then. Continued progress in the response to COVID-19, including further stimulus, will be key to sustaining the recovery. As the pandemic subsides, restrictions are lifted, and consumers’ daily lives return to something close to normal, the pace of the recovery should pick up speed—probably in the middle of 2021.

Prepare to power forward in 2021 with the economic insights and market guidance in LPL Research Outlook 2021: Powering Forward.

Do you have a written financial plan to grow your net worth and protect your retirement? Set up a consult to get a financial plan and advice you can understand.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

If your representative is located at a bank or credit union, please note that the bank/credit union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL may also be employees of the bank/credit union.

These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, the bank/credit union. Securities and insurance offered through LPL or its affiliates are:

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use | Tracking # 1-05129063