US payrolls grew month over month in January following a brief dip into negative territory in December. Peering under the hood, though, this report did little to dispel the notion that the labor market’s recovery has been stalling out, and likely bolsters calls for additional fiscal stimulus.

The US Bureau of Labor Statistics released its monthly employment report this morning, revealing that the domestic economy added 49,000 jobs in January, falling short of Bloomberg-surveyed economists’ forecasts for a 105,000 gain. Large negative revisions to December’s number, as well as January’s large seasonality adjustments, cast this positive headline number in a somewhat more nebulous light. The unemployment rate notably fell to 6.3% from 6.7%, but that was paired with a labor force participation rate that declined to 61.4% from 61.5%.

Average hourly earnings rose 0.2% month over month and 5.4% year over year, signaling lower-wage workers have borne the brunt of job losses. One cohort of the labor market being disproportionately affected distorts these figures and reduces their usefulness as a gauge of whether inflation could begin to creep into the picture. The recently released Employment Cost Index, though, adjusts for these distortions and showed fourth quarter growth of 0.7% quarter over quarter and 2.5% year over year. This is below the prior cycle peak of 3.2% year over year, and therefore is not a present threat in our opinion.

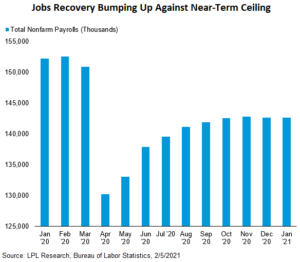

As seen in the LPL Chart of the Day, the jobs recovery has plateaued just under the 143 million payrolls level in the last four months. This follows an initial sharp recovery off April’s bottom, and it should come as no surprise that the tapering off has coincided with rising case counts and colder weather. We remain about 9.9 million jobs short of February 2020’s 152.5 million peak.

The composition of January’s report follows trends that are all too familiar from previous COVID-19 spikes, the dichotomy between jobs that can be done at home and those that cannot. Retail trade lost 37,800 jobs while the leisure and hospitably industry lost 61,000, two segments that have been hardest hit throughout the pandemic. Meanwhile, professional and business services added 97,000 jobs and government jobs increased by 43,000.

“The past few months on jobs day, we have flagged the need for fiscal stimulus to get us through to the other side of this economic soft patch,” explained LPL Financial Chief Market Strategist Ryan Detrick. “As the pace of vaccinations picks up, we are hopeful that the job market may soon start to benefit from more sustainable economic growth.”

Earlier this week, an important milestone made headlines across the country as the total number of vaccinations administered surpassed the total number of COVID-19 cases. Boots on the ground are becoming increasingly efficient at distributing the vaccine, and positive trial data boosted hope that a third vaccine soon may be made available for emergency use. Obviously, as a larger proportion of the population receives their vaccinations, economic activity can pick up and hiring in hard-hit service jobs can resume.

We may already be seeing nascent signs of this. The jobs report’s window cuts off at the end of the week containing the 12th of the month. Initial claims for unemployment data, however, improved notably in the second half of the January. If the improvement in layoffs were also reflected in hiring, we would expect that to show in next month’s report. We may be slightly early in our optimism, but when paired with warmer weather on the horizon, vaccination progress gives us hope that we will soon break through this near-term ceiling in total US payrolls.

Do you have our 2021 Market Outlook? Request it free!

Book a consultation or contact us today.

Book a consultation or contact us today.

Our 2021 Market Outlook is here! What does the stock market in 2021 have in store for us? 2021 will bring advances to further limit the impact of COVID-19, and the goal remains keeping the economy as open as possible until then. Continued progress in the response to COVID-19, including further stimulus, will be key to sustaining the recovery. As the pandemic subsides, restrictions are lifted, and consumers’ daily lives return to something close to normal, the pace of the recovery should pick up speed—probably in the middle of 2021.

Prepare to power forward in 2021 with the economic insights and market guidance in LPL Research Outlook 2021: Powering Forward.

Do you have a written financial plan to grow your net worth and protect your retirement? Set up a consult to get a financial plan and advice you can understand.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

If your representative is located at a bank or credit union, please note that the bank/credit union is not registered as a broker-dealer or investment advisor. Registered representatives of LPL may also be employees of the bank/credit union.

These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, the bank/credit union. Securities and insurance offered through LPL or its affiliates are:

- Not Insured by FDIC/NCUA or Any Other Government Agency

- Not Bank/Credit Union Guaranteed

- Not Bank/Credit Union Deposits or Obligations

- May Lose Value

For Public Use | Tracking # 1-05108440